Southern California 2Q23 Multifamily Market Insights Report: Rent growth resumes even as vacancies push higher

Highlights:

Image

- Operating conditions in Southern California were mixed through the first half of 2023 as vacancy conditions ticked higher and asking rents rose. Developers remain active with projects totaling 37,475 units currently under construction throughout the region.

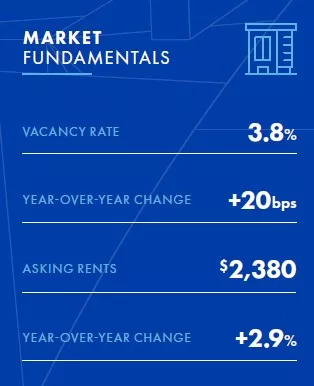

- Asking rents in Southern California trended higher during the second quarter; rents in the region rose 1.6% to $2,380 per month. Year over year, average rents are up 2.9%. Rent trends in Class A properties have been mixed. Class A asking rents in San Diego have posted healthy gains, but top-tier rents in the other Southern California markets have recorded minimal increases or modest declines during the past year.

- Overall vacancy conditions inched higher in recent months, rising 20 basis points during the second quarter to 3.8%. The current vacancy rate is also up 20 basis points year over year. Operating conditions in Class B and Class C properties remain very tight, with vacancy averaging about 2%. Class A vacancies reached 5.6% at midyear, with Los Angeles and San Diego having the highest rates.

- Fewer multifamily properties sold in Southern California during the second quarter than in the first three months of the year. Cap rates have edged higher in recent quarters, and prices have dipped. The median sales price year to date is $283,300 per unit, while most properties are selling with cap rates between 4% and 5.5%.

Read the report, or engage with our Los Angeles, San Diego or Irvine offices.

Related Articles

Insights

Research to help you make knowledgeable investment decisions